Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant | |

| CHECK THE APPROPRIATE BOX: |

| ☐ | | Preliminary Proxy Statement |

¨☐ | | Confidential, forFor Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

þ☑ | | Definitive Proxy Statement |

¨☐ | | Definitive Additional Materials |

¨☐ | | Soliciting Material Pursuant to§240.14a-12Under Rule 14a-12 |

McDermott International, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other thanOther Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þPAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): |

| ☑ | | No fee required. |

¨☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and0-11. |

| (1) | | 1) Title of each class of securities to which transaction applies: |

| (2) | | 2) Aggregate number of securities to which transaction applies: |

| (3) | | 3) Per unit price or other underlying value of transaction computed pursuant to Exchange ActRule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | | 4) Proposed maximum aggregate value of transaction: |

¨☐ | | Fee paid previously with preliminary materials.materials: |

¨☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Formform or Scheduleschedule and the date of its filing. |

| (1) | | 1) Amount Previously Paid:previously paid: |

| (2) | | 2) Form, Schedule or Registration Statement No.: |

| | | 3) Filing Party: |

| | | 4) Date Filed: |

Table of Contents

| Notice of Annual Meeting |

| and |

| 2018 Proxy Statement |

|

|

Table of Contents

Forward-Looking Statements

McDermott cautions that the statements in this proxy statement which are forward-looking, and provide other than historical information, involve risks, contingencies and uncertainties that may impact actual results of operations of McDermott. These forward-looking statements include, among other things, statements about backlog, to the extent backlog may be viewed as an indicator of future revenues, and about the expected benefits resulting from McDermott’s combination with Chicago Bridge & Iron Company N.V. and McDermott’s strategic objectives. Although we believe that the expectations reflected in those forward-looking statements are reasonable, we can give no assurance that those expectations will prove to have been correct. Those statements are made by using various underlying assumptions and are subject to numerous risks, contingencies and uncertainties which may cause actual results to differ materially from the forward-looking statements, including, among others: the possibility that the expected synergies from the combination will not be realized, or will not be realized within the expected time period; difficulties related to the integration of the two companies; the diversion of management time and attention on the post-combination integration efforts; adverse changes in the markets in which McDermott operates or credit markets; our credit ratings; the inability of McDermott to execute on contracts in backlog successfully; changes in project design or schedules; the availability of qualified personnel; changes in the terms, scope or timing of contracts; contract cancellations; change orders and other modifications and actions by customers and other business counterparties of McDermott; changes in industry norms; and adverse outcomes in legal proceedings, regulatory proceedings or enforcement matters. If one or more of these risks materialize, or if underlying assumptions prove incorrect, actual results may vary materially from those expected. You should not place undue reliance on forward-looking statements. For a more complete discussion of these and other risk factors, please see McDermott’s annual and quarterly filings with the Securities and Exchange Commission, including its annual report on Form 10-K for the year ended December 31, 2017 and subsequent quarterly reports on Form 10-Q. Except to the extent required by applicable law, McDermott undertakes no obligation to update or revise any forward-looking statement.

Table of Contents

LETTER TO STOCKHOLDERS

To My Fellow Stockholders:

2017 was not only a year of continued financial success, but also a year of tremendous strategic and operational significance for McDermott. Most notably, in December 2017, we announced our agreement with Chicago Bridge & Iron Company N.V (“CB&I”) to combine to create a premier, fully integrated, onshore-offshore company, with a broad engineering, procurement, construction and installation (EPCI) service offering and market leading technology portfolio. Our combination with CB&I closed effective May 10, 2018, which marks a big step toward our goal of being a true global leader in our industry. That transaction, together with our notable 2017 financial results, demonstrates our unwavering dedication to the successful execution of our strategy of maintaining a sustainable, profitable and growth-oriented business with a focus on stockholders, customers and other stakeholders. With the completion of the combination, we have substantially diversified our capabilities and are well-positioned globally in attractive, high-growth markets.

We are pioneering a new kind of company that can work together with our customers to provide integrated, end-to-end solutions—from wellhead to storage tank—that deliver the quality, efficiency and certainty needed to keep their businesses growing. Our strategic objectives are to:

| ● | Growrevenue and earnings by leveraging our end-to-end onshore/offshore solutions offerings to global energy customers, steadily expanding our EPC portfolio in petrochemical and refining by capitalizing on pull-through opportunities provided by our technology business, and maximizing the benefit of revenue and cost synergies, with relentless focus on risk management and operating efficiency. |

| ● | Expand our leadership position in served markets and technology. |

| ● | Sustain our tier-one safety performance. |

| ● | Maintain a disciplined capital allocation plan by reducing total debt and maintaining a competitive level of capital investment. |

Our 2017 executive compensation programs were thoughtfully structured to align with and drive our operational performance and achieve financial targets. In making compensation decisions for 2017, the Compensation Committee considered our operating strategy, goals and significantly improved operational and financial performance, with appreciation of the prevailing macro oil and gas environment and comments received during stockholder outreach conducted over the past few years.

We also continued our thoughtful, forward-looking and stockholder informed approach to corporate governance in 2017. In line with our belief that an effective Board cannot remain static, Philippe Barril was appointed to the Board as a new independent director in September 2017. Then, with the closing of the combination, in May 2018, we welcomed five new, experienced and qualified members to our Board: Messrs. Forbes I.J. Alexander, L. Richard Flury, W. Craig Kissel and James H. Miller and Ms. Marsha C. Williams. Together, these new directors bring a valuable mix of diverse skill-sets to our Board that will help to support our long term strategy.

| “McDermott’s remarkable transformation, which most recently included the strategic and operational milestones achieved in 2017 and the combination with CB&I in 2018, reflects the commitment of our Board, executive management and employees to carrying out our operating strategy in a difficult macro environment.” |

Thanks to their efforts, we believe that, today, McDermott has the global reach, integrated technology, engineering expertise and construction experience to design and build the energy infrastructure of the future.

I am pleased to invite you to attend McDermott’s 2018 Annual Meeting of Stockholders. The accompanying Proxy Statement further highlights key activities and accomplishments of 2017 and contains information on the matters for which we are seeking your vote at this year’s Annual Meeting. On behalf of the Board, our executive management team, and the entire McDermott organization, thank you for your continued interest and support, as we seek to leverage the momentum of our recent strategic and operational accomplishments and look to the future.

Sincerely yours,

|  |

| Gary P. Luquette |

| Independent Chair of the Board |

| August 10, 2018 |

Date Filed:YOUR VOTE IS IMPORTANT.

Whether or not you plan to attend the meeting, please take a few minutes now to vote your shares. |

| www.mcdermott.com |  |

Table of Contents

McDERMOTT INTERNATIONAL, INC.

757 N. Eldridge Pkwy.

Houston, Texas 77079

NOTICE OF 2018 ANNUAL MEETINGOF STOCKHOLDERS

| Time |  | Location |

8:00 a.m., local time,

on Wednesday, September 26, 2018 | | McDermott International, Inc.

|

| | |

| |

David Dickson

| | 757 N. Eldridge Pkwy. |

President and Chief Executive Officer

| | Houston, Texas 77079Claridge’s

Brook Street

Mayfair

London W1K 4HR

United Kingdom |

March 27, 2015

Dear Stockholder:

Record Date and Voting

You are cordially invitedentitled to attend this year’s Annual Meetingvote if you were a stockholder of Stockholdersrecord at the close of McDermott International, Inc., which will be heldbusiness on Friday, May 8, 2015, at The Westin Houston Hotel, 945 Gessner Road, Houston, Texas 77024, commencing at 10:00 a.m., local time. The noticeJuly 30, 2018 (the “Record Date”). Each share of Annual Meetingcommon stock is entitled to one vote for each director nominee and proxy statement following this letter describeone vote for each of the mattersother proposals to be actedvoted on at the meeting.

McDermott is utilizing the Securities and Exchange Commission’s Notice and Access proxy rule, which allows companies to furnish proxy materials via the Internet as an alternative to the traditional approach of mailing a printed set to each stockholder. In accordance with these rules, we have sent a Notice of Internet Availability of Proxy Materials to all stockholders who have not previously elected to receive a printed set of proxy materials. The Notice contains instructions on how to access our 2015 Proxy Statement and Annual Report to Stockholders, as well as how to vote either online, by telephone or in person at the 2015 Annual Meeting.

It is very important that your There were 180,536,768 shares are represented and voted at the Annual Meeting. Please vote your shares by Internet or telephone, or, if you received a printed set of materials by mail, by returning the accompanying proxy card, as soon as possible to ensure that your shares are voted at the meeting. Further instructions on how to vote your shares can be found in our Proxy Statement.

Thank you for your support of our company.

Sincerely yours,

DAVID DICKSON

YOUR VOTE IS IMPORTANT.

Whether or not you plan to attend the meeting, please take a few minutes now to vote your shares.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on May 8, 2015.

The proxy statement and annual report are availablecommon stock outstanding on the Internet at www.proxyvote.com.

The following information applicable to the Annual Meeting may be found in the proxy statement and accompanying proxy card:

The date, time and location of the meeting;

A list of the matters intended to be acted on and our recommendations regarding those matters;

Any control/identification numbers that you need to access your proxy card; and

Information about attending the meeting and voting in person.

McDERMOTT INTERNATIONAL, INC.

757 N. Eldridge Pkwy.

Houston, Texas 77079

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS

Record Date.

Time and Location

| 10:00 a.m., local time, on Friday, May 8, 2015

|

Items of Business |

| 1 | 1. | To elect eighteleven members to our Board of Directors, each for a term extending until our 2019 Annual Meeting of one year. Stockholders. |

| 2 | 2. | To conduct an advisory vote to approve named executive officer compensation. |

| 3 | 3. | To ratify our Audit Committee’s appointment of DeloitteErnst & ToucheYoung LLP as our independent registered public accounting firm for the year ending December 31, 2015. 2018. |

| 4 | 4. | To transact such other business that properly comes before the meeting or any adjournment thereof. |

Notice and Access

Instead of mailing a printed copy of our proxy materials, including our Annual Report on Form 10-K, to each stockholder of record, we are providing access to these materials via the Internet. This reduces the amount of paper necessary to produce these materials, as well as the costs associated with mailing these materials to all stockholders. Accordingly, on August 10, 2018, we began mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders of record as of the Record Date, and posted our proxy materials on the Web site referenced in the Notice (www.proxyvote.com). As more fully described in the Notice, all stockholders may choose to access our proxy materials on the Web site referred to in the Notice and/ or may request a printed set of our proxy materials. In addition, the Notice and Web site provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

Record Date

| You are entitled to vote if you were a stockholder of record at the close of business on March 12, 2015.

|

Attending the Annual Meeting

See page 71, “Questions and Answers About the Annual Meeting and Voting” for details.

Notice and Access

| Instead of mailing a printed copy of our proxy materials, including our Annual Report, to each stockholder of record, we are providing access to these materials

By Order of the Board of Directors, John M. Freeman John M. Freeman

Corporate Secretary August 10, 2018 Proxy Voting Your vote is important. Please vote via the Internet. This reduces the amount of paper necessary to produce these materials, as well as the costs associated with mailing these materials to all stockholders. Accordingly, on March 27, 2015, we began mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders of record as of March 12, 2015, and posted our proxy materials on the Web site referenced in the Notice (www.proxyvote.com). As more fully described in the Notice, all stockholders may choose to access our proxy materials on the Web site referred to in the Notice and/or may request a printed set of our proxy materials. In addition, the Notice and Web site provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. |

Proxy Voting

| Your vote is important. Please vote your proxy promptly so your shares can be represented, even if you plan to attend the Annual Meeting. You can vote by Internet, by telephone or by requesting a printed copy of the proxy materials and using the proxy card enclosed with the printed materials.

|

Meeting Admission

| Attendance at the meeting is limited to stockholders and beneficial owners as of the record date or duly appointed proxies. No guests will be admitted, except for guests invited by McDermott. Registration will begin at 9:00 a.m., and the meeting will begin promptly at 10:00 a.m. If your shares are held in “street name” through a broker, bank, trustee or other nominee, you are a beneficial owner, and beneficial owners will need to show proof of beneficial ownership, such as a copy of a brokerage account statement, reflecting stock ownership as of the record date in order to be admitted to the meeting. If you are a proxy holder for a stockholder, you will need to bring a validly executed proxy naming you as the proxy holder, together with proof of record ownership of the stockholder naming you as proxy holder. Please note that you may be asked to present valid photo identification, such as a valid driver’s license or passport, when you check in for registration. No cameras, recording equipment or other electronic devices will be allowed to be brought into the meeting room by stockholders or beneficial owners.

BY INTERNET |

By Order of the Board of Directors,

LIANE K. HINRICHS

Secretary

March 27, 2015

PROXY STATEMENT FOR

2015 ANNUAL MEETING OF STOCKHOLDERS

TABLE OF CONTENTS

| | | | www.proxyvote.com |

| | |

Page | BY TELEPHONE |

| Toll-free 1-800-690-6903 |

| |

| BY MAIL |

| Follow instructions on your proxy card |

| |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on September 26, 2018.

The proxy statement and Annual Report on Form 10-K are available on the Internet atwww.proxyvote.com.

The following information applicable to the Annual Meeting may be found in the proxy statement and accompanying proxy card:

| ● | The date, time and location of the meeting; |

| ● | A list of the matters intended to be acted on and our recommendations regarding those matters; |

| ● | Any control/identification numbers that you need to access your proxy card; and |

| ● | Information about attending the meeting and voting in person. |

| 2018 PROXY STATEMENT |

Table of Contents

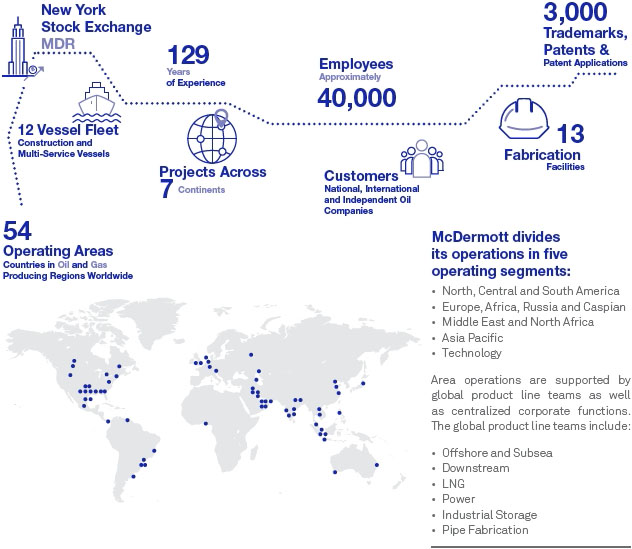

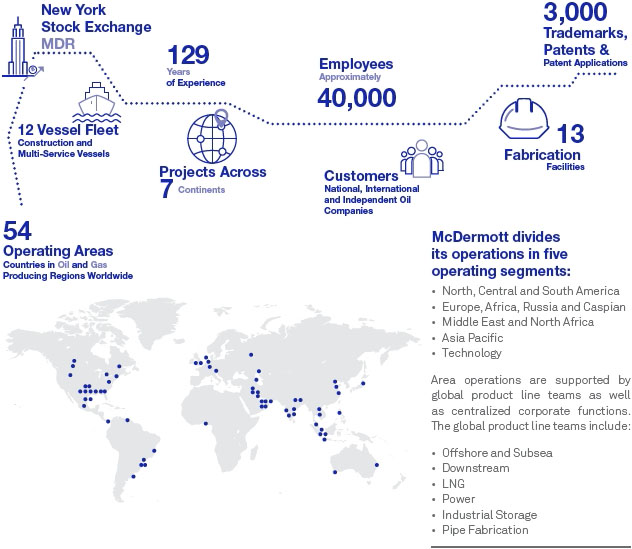

ABOUT MCDERMOTT

McDermott is a premier, fully-integrated provider of technology, engineering and construction solutions to the energy industry. For more than a century, customers have trusted McDermott to design and build end-to-end infrastructure and technology solutions—from the wellhead to the storage tank—to transport and transform oil and gas into the products the world needs today. Our proprietary technologies, integrated expertise and comprehensive solutions deliver certainty, innovation and added value to energy projects around the world.

Customers rely on McDermott to deliver certainty to the most complex projects, from concept to commissioning. We call it the “One McDermott Way.”

McDermott at a Glance

Learn more about our strategy and how we are building a new kind of company

at https://www.mcdermott.com/Who-We-Are

| www.mcdermott.com |  |

Table of Contents

CORPORATE RESPONSIBILITY

McDermott focuses its corporate responsibility efforts in three main areas:

| 1. | Conducting our global business to the highest ethical standards; |

| 2. | Being a good neighbor around the world where our employees live and work through responsible environmental practices and community involvement; and |

| 3. | Providing a safe, healthy and hospitable work environment that embraces diversity and offers career development opportunities. |

| ETHICAL BUSINESS PRACTICES |

McDermott is strongly committed to conducting its worldwide business activities in accordance with high ethical standards that are derived from such fundamental values as honesty, integrity, reliability, fairness, mutual respect and trust. We believe this is the right way to operate our businesses. The Board of McDermott has adopted a Code of Ethics and Corporate Governance Guidelines that ensure compliance with applicable laws and regulations and encourage the highest standards of integrity in the conduct of our business.

Good Neighbor Practices

For McDermott, being a good neighbor means protecting the environment at our jobsites and facilities worldwide. It also means improving the quality of life in the communities where our employees live and work through community involvement, work force development initiatives, and using local suppliers when possible.

| | Proxy SummaryCommunity involvement.McDermott employees volunteer their time to health, educational and human service organizations in communities across the globe, and we support social, economic and cultural development initiatives in conjunction with many of our major projects. Local operations identify those with the greatest need and develop partnerships to support the health, safety and well-being of their neighbors. Employees are generous with their time and often volunteer after-hours or on weekends to support the greater good.

|

Responsible Workplace Practices

McDermott is committed to treating every employee with respect and dignity and providing a safe, hospitable and quality work environment. We recognize that a motivated, well-trained, diverse workforce is a significant competitive advantage.

| | Health and safety.Safety is a core value at McDermott. It is the responsibility of every employee, and zero incidents is our foremost goal. We implement rigorous controls through every phase of our projects, and our employees receive extensive training on how to perform their jobs safely, properly and in compliance with environmental regulations. We are committed to fostering a culture where open communication about safety by all personnel is considered normal, and accountability for safety performance is applied appropriately. |

| | | i | |

| | QuestionsRespecting diversity.In the course of our more than 125-year history, McDermott has assembled a talented workforce from locations around the world, intermingling employees from all cultures and Answers abouttraditions to best leverage their talent and expose them to career development opportunities. On many of our larger jobs, the Annual Meetingproject team often comprises individuals of Stockholders and Voting25 or more different nationalities working together toward a common goal. Many employees who first joined McDermott in their home country subsequently move with us from project to project around the world.

|

| | | 1 | |

| | Item 1 — ElectionHospitable workplace.McDermott is firmly committed to a workplace free from discrimination, hostility or harassment. The company has a policy of Directorspromoting equal opportunity in employment without discrimination based upon race, color, religion, sex, gender, age, national origin, disability or any other status protected under applicable law. Discrimination or harassment based upon any of these characteristics is prohibited and will not be tolerated.

|

| | | 6 | |

Election Process

| | | 6 | |

Director Qualifications

| | | 6 | |

Director Nominations

| | | 6 | |

2015 Nominees

| | | 7 | |

Corporate GovernanceEmployee development.

| | | 11 | |

Director Independence

| | | 11 | |

Executive Sessions

| | | 12 | |

Communications WithMcDermott is committed to providing our employees with a work environment that is conducive to development and career growth. We provide employees with numerous opportunities to improve their skills, further their education and advance within the Boardcompany.

| | | 12 | |

Board of Directors and Its Committees

| | | 12 | |

The Board’s Role in Risk Oversight

| | | 15 | |

Compensation Policies and Practices and Risk

| | | 15 | |

Compensation Committee Interlocks and Insider Participation

| | | 16 | |

Compensation of Directors

| | | 17 | |

Director Compensation Table

| | | 17 | |

Executive Officer Profiles

| | | 19 | |

Compensation Discussion and Analysis

| | | 26 | |

Executive Summary

| | | 26 | |

How We Make Compensation Decisions

| | | 32 | |

Compensation Philosophy

| | | 32 | |

Impact of 2014 Say-on-Pay Vote on Executive Compensation

| | | 32 | |

Defining Market Range Compensation – Benchmarking

| | | 33 | |

What We Pay and Why: Elements of Total Direct Compensation

| | | 34 | |

2014 NEO Compensation

| | | 39 | |

2014 Other Compensation Elements

| | | 42 | |

Other Compensation Policies and Practices

| | | 45 | |

Survey Peer Group

| | | 47 | |

Compensation Committee Report

| | | 48 | |

Compensation of Executive Officers

| | | 49 | |

Summary Compensation Table

| | | 49 | |

Grants of Plan-Based Awards

| | | 51 | |

Outstanding Equity Awards at Fiscal Year End

| | | 52 | |

Option Exercises and Stock Vested

| | | 54 | |

Pension Benefits

| | | 55 | |

Nonqualified Deferred Compensation

| | | 57 | |

Potential Payments Upon Termination or Change in Control

| | | 58 | |

Item 2 — Advisory Vote to Approve NEO Compensation

| | | 64 | |

Audit Committee Report

| | | 66 | |

Item 3 — Ratification of Appointment of Independent Registered Public Accounting Firm for Year Ending December 31, 2015

| | | 67 | |

Security Ownership of Directors and Executive Officers

| | | 69 | |

Security Ownership of Certain Beneficial Owners

| | | 70 | |

Certain Relationships and Related Transactions

| | | 71 | |

Section 16(a) Beneficial Ownership Compliance

| | | 71 | |

Stockholders’ Proposals

| | | 72 | |

| 2018 PROXY STATEMENT |

Table of Contents

PROXY SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully. As used in this proxy statement, unless the context otherwise indicates or requires, references to “McDermott,” “we,” “us,” and “our” mean McDermott International, Inc. and its consolidated subsidiaries.

We first sent or provided this proxy statement and the form of proxy for our 2018 Annual Meeting of Stockholders

to our stockholders beginning on August 10, 2018.

| | |

• Time and Date:

| | 10:00 a.m., local time, May 8, 2015 |

• Place:

| | The Westin Houston Hotel

945 Gessner Road

Houston, Texas 77024

|

• Record Date:

| | March 12, 2015 |

• Voting:

| | Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on.ITEM 1

ELECTION OF DIRECTORS |

ItemsThe Board of BusinessDirectors has nominated eleven candidates, each for thea term extending until our 2019 Annual Meeting

of Stockholders, and recommends that stockholders vote for each nominee based on their specific background, experience, qualifications, attributes and skills.

| | | | |

| | | | |

Item of Business | The Board recommends a voteFOReach director nominee |  | Page 13 |

Board and Corporate Governance Highlights

We are committed to maintaining the highest standards of corporate governance. The Board has built a strong and effective governance framework, which has been designed to promote the long-term interests of stockholders and support Board and management accountability.

| | | | Director

Since | | Committees | | Other Current Public

Company Boards |

| | Forbes I.J. Alexander,58Independent

Chief Financial Officer Jabil, Inc. | | 2018 | | ●Audit | | ●None |

| | Philippe Barril,53Independent

Chief Operating Officer SBM Offshore, N.V. | | 2017 | | ●Audit ●Transition (Chair) | | ●None |

| | Board VoteJohn F. Bookout, III,64Independent

RecommendationPartner Apollo Global Management, LLC | | 2006 | | ●Governance | | ●None |

| | PageDavid Dickson,50

ReferencePresident, Chief Executive Officer McDermott | | 2013 | | ●Transition | | ●None |

| | L. Richard Flury,71Independent

Chief Executive Officer Gas Power and Renewables BP plc (retired) | | 2018 | | ●Compensation ●Governance (Chair) | | ●Callon Petroleum Corporation |

| | W. Craig Kissel,67Independent

President, Commercial Systems Trane, Inc. (retired) | | 2018 | | ●Compensation (Chair) | | ●Watts Water Technologies |

| | Gary P. Luquette,62Independent

President, Chief Executive Officer Frank’s International N.V. (retired)

Non-Executive Chair of the Board McDermott | | 2013 | | ●Compensation ●Transition | | ●Southwestern Energy Company ●Apergy Corporation |

| | James H. Miller,69Independent

Chairman PPL Corporation (retired) | | 2018 | | ●Governance | | ●AES Corporation ●Crown Holdings, Inc. |

| | William H. Schumann, III,68Independent

Executive Vice President FMC Technologies, Inc. (retired) | | 2012 | | ●Audit (Chair) | | ●Avnet, Inc. ●Andeavor |

| | Mary L. Shafer-Malicki,57Independent

Senior Vice President, Chief Executive Officer BP Angola (retired) | | 2011 | | ●Compensation ●Governance | | ●Wood PLC ●QEP Resources, Inc. |

| | Marsha C. Williams,67Independent

Senior Vice President, Chief Financial Officer Orbitz Worldwide, Inc.

(retired) | | 2018 | | ●Audit | | ●Fifth Third Bancorp ●Modine Manufacturing Company, Inc. |

| www.mcdermott.com |  |

Table of Contents

|

1. Election of directors

| | FOR Each

Director Nominee | | 610Independent Directors |

2. Advisory vote to approve named executive officer compensation

| | FOR | | 64 |

3. Ratification of Deloitte & Touche LLP as auditor for 2015

| | FOR | | 67 |

| | | | |

Your vote is important. Please vote your proxy promptly so your shares can be represented, even if you plan to attend the Annual Meeting. Stockholders of record can vote by Internet, by telephone, or by requesting a printed copy of the proxy materials and using the proxy card enclosed with the printed materials.

Item 1 — Election of Directors

The Board of Directors has nominated eight candidates, each for a one-year term. Our Board of Directors recommends that stockholders vote “For” each of the nominees named below.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | | Director

Since | | | Independent | | | Committee Memberships |

| | | | Audit | | Compensation | | Finance | | Governance |

| | | | | | | | | | | | | | | | | | | | | |

John F. Bookout, III | | | 61 | | | | 2006 | | | | X | | | | | | | X | | X |

Roger A. Brown | | | 70 | | | | 2005 | | | | X | | | | | X | | | | X |

David Dickson | | | 47 | | | | 2013 | | | | | | | | | | | | | |

Stephen G. Hanks | | | 64 | | | | 2009 | | | | X | | | X | | | | | | Chairman |

Gary P. Luquette | | | 59 | | | | 2013 | | | | X | | | | | X | | | | |

William H. Schumann, III | | | 64 | | | | 2012 | | | | X | | | Chairman | | | | X | | |

Mary L. Shafer-Malicki | | | 54 | | | | 2011 | | | | X | | | | | Chairman | | | | X |

David A. Trice | | | 67 | | | | 2009 | | | | X | | | X | | | | Chairman | | |

| | | | | | | | | | | | | | | | | | | | | |

i

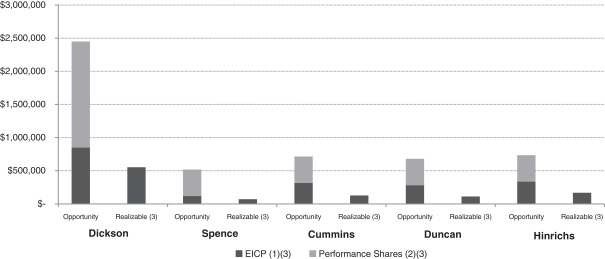

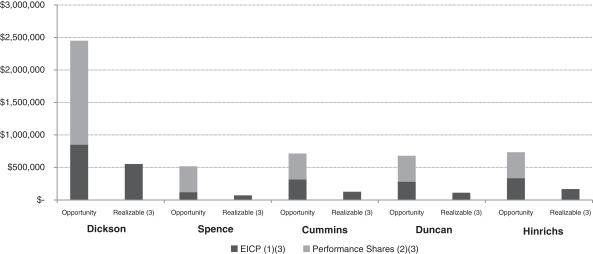

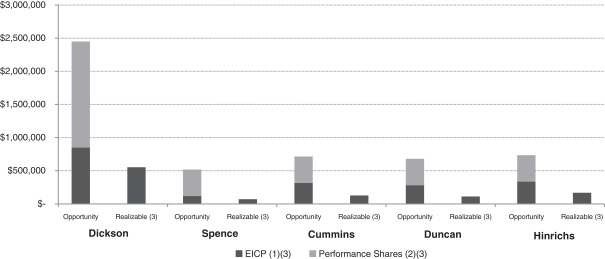

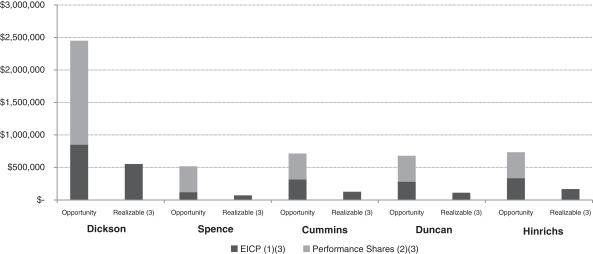

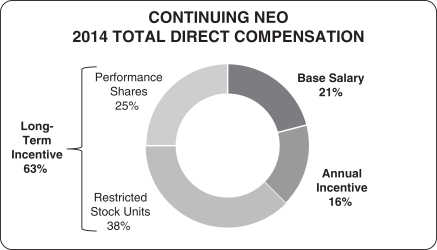

2014 Compensation Program and Realizable Value of Performance-Based Awards

As in prior years, the Compensation Committee continued to believe that a significant portion of a 2014 Named Executive Officer’s (“NEO’s”) compensation should be performance-based, designed for the purpose of aligning the interests of our NEOs with those of stockholders by rewarding performance that meets or exceeds established goals, with the ultimate objective of increasing stockholder value. Following an operating loss in 2013, a challenging outlook for 2014 and the anticipated need for significant strategic and operational actions to commence the turnaround of our business, the Compensation Committee implemented several changes to McDermott’s compensation programs for 2014. Those changes took into consideration our need for the 2014 compensation arrangements to attract, develop, retain and motivate the NEOs and other executive officers during our turnaround efforts, including challenges associated with stabilizing our company, delivering improved financial and operational performance and repositioning McDermott for long-term growth.

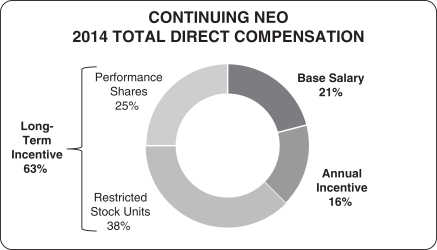

Reflecting the Compensation Committee’s philosophy and these considerations, compensation arrangements in 2014 provided for the continuing use of three elements of target total direct compensation:

annual incentive, with performance metrics under our Executive Incentive Compensation Plan, or EICP, designed to align with near-term operational priorities, composed entirely of performance-based compensation; and

long-term incentive, or LTI, with emphasis on restricted stock units to provide stability and support the retention of key employees during the organizational and leadership transition.

McDermott’s financial performance resulted in revenues for the year ended December 31, 2014 of $2.3 billion, operating income of $8.6 million and year end backlog of $3.6 billion. Notwithstanding the significant improvement in performance over the financial results achieved for the year ended December 31, 2013, this performance, inIn accordance with our Compensation Committee’s philosophy and program, and based onCorporate Governance Guidelines,10of our11directors are independent,including the value of our common stock at year end, resulted in:

Financial performance under the EICP that (as per the EICP) would have resulted in bonus pool funding of 1.015x. This amount was, following the recommendation of executive management (with consideration of our non-attainmentChair of the threshold level for the order intake component of the financial performance goals), reduced by over 50% by the Compensation Committee, through the exercise of its discretion, to funding of 0.5x.

NEO performance shares granted in 2011, 2012, 2013 and 2014 having no realizable value as of December 31, 2014.

ii

The following table summarizes the 2014 performance-based compensation opportunities, as compared to the realizable values of such opportunities as of December 31, 2014, for each of our NEOs:

2014 Performance-Based Compensation Opportunity vs.

Realizable Value as of December 31, 2014

Board.

(1) | Opportunity values for EICP are presented using the NEOs’ target EICP award levels.

TENURE BALANCE |

(2)1

10 years

or more | Opportunity values for performance shares are presented using the grant date fair value of the respective awards.

| | | 3

1 to 5

years | | |

(3) | The 2014 realizable values shown above are measured as of December 31, 2014. The realizable value of EICP awards shown above is based on each NEO’s actual earned EICP award. The realizable value of performance share awards shown above is based on the estimated payout as a percent of target based upon an extrapolation of 2014 operating income of $8.6 million over the three-year performance period, or 0% of the performance shares granted in 2014, multiplied by the closing price of our common stock as reported on the NYSE as of December 31, 2014 ($2.91). This value does not take into account our forecast or expectations for actual performance over the three-year performance period. The number of the performance shares granted in 2014 that ultimately vest, if any, will be determined by reference

| | | | | |

| | | | | | |

| | | | | | |

| | 2

5 to performance goals over a three-year period and may be more or 10

years | | | | 5

less than indicated in the table. The vesting of any of these performance shares would impact the future realizable value of these performance share awards.

1 year |

CompensationOur Board is appropriately refreshed, and Corporate Governance Policiesour directors bring a balance of experience and Proceduresfresh perspectives.

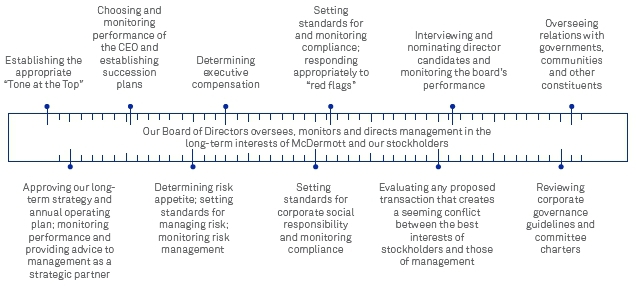

| CORPORATE GOVERNANCE HIGHLIGHTS |

McDermott’s Board has implemented several policies and structures that we believe are “best practices”among best practices in corporate governance. The Corporate Governance section of this proxy statement beginning on page 13 describes our governance including:

Separatingframework, which includes the Chairmanfollowing:

| CURRENT BOARD AND GOVERNANCE INFORMATION |

11

Size of Board | 10

Number of

Independent Directors | 15

Board Meetings

Held in 2017 | 72

Mandatory

Retirement Age | 62

Average Age

of Directors |

| Separate Chair and CEO |

| Annual Board and Committee Evaluations |

| Independent Directors Meet in Executive Sessions |

| Board Orientation |

| Succession Planning Oversight |

| Board Risk Oversight |

| Code of Conduct for Directors, Officers and Employees |

| Stock Ownership Guidelines for Directors and Executive Committee, or EXCOM, Members |

| Anti-Hedging and Pledging Policies |

| Clawback Policy and Forfeiture Provisions |

| Stockholder Outreach Program |

| 2018 PROXY STATEMENT |

Table of the Board and Chief Executive Officer roles;Contents

ITEM 2

ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION |

Holding Board meeting executive sessions with independent directors only present;

Maintaining minimum stock ownership guidelines applicable to directors and executive officers;

Approving a policy prohibiting all directors, officers and employees from engaging in “short sales” or trading in puts, calls or other options on McDermott’s common stock, and from engaging in hedging transactions and from holding McDermott shares in a margin account or pledging McDermott shares as collateral for a loan;

Eliminating excise tax gross-ups; and

The Compensation Committee of the Board of Directors engaging Pay Governance LLC, an independent executive compensation consultant.

iii

Item 2 — Advisory Vote to Approve Named Executive Officer Compensation

Our stockholders have the opportunity to cast a non-binding advisory vote on the compensation of our named executive officers. Last year, over 86% of the votes cast on this proposal were in favor of our executive compensation program. We recommend that you review our Compensation Discussion and Analysis beginning on page 26,35, which explains in greater detail the philosophy of the Compensation Committee and its actions and decisions during 2014in 2017 regarding our compensation programs. While the outcome of this proposal is non-binding, the Board and Compensation Committee will consider the outcome of the vote when making future compensation decisions.

| | | |

| The Board recommends a voteFORthis proposal |  | Page 35 |

| 2017 OPERATING STRATEGY AND GOALS |

Since David Dickson’s appointment as Chief Executive Officer in December 2013, McDermott has transformed as a company and positioned itself for the anticipated upturn in the oilfield services industry through a turnaround, stabilization of the business and optimization via cost-reduction initiatives. McDermott has also been focused on sustainability and growth, through strategic asset investment and the combination with Chicago Bridge & Iron Company N.V. (“CB&I”) announced in late 2017, which closed effective May 10, 2018.

| 1 | | | | 2 | | | | 3 |

| Stabilization | |  | | Optimization | |  | | Looking Ahead |

●New leadership took countermeasures to stop multi-year EBIT decline ●Stronger relationships with key customers—signaled a transformation of McDermott | | | | ●Undertook cost-reduction programs and business development efforts across existing business lines ●Additional measures taken to improve process and asset refreshment | | | | ●Maintain strong focus on strengthening customer relationships ●Maintain strong focus on operational and cost effectiveness |

In 2017 our operating strategy was to maintain a sustainable, profitable and growth-oriented business, with a focus on stockholders, customers and other stakeholders. In furtherance of this strategy, our 2017 goals were to:

●increase operating income via improved project execution;

●increase cash flow by prioritizing our liquidity needs;

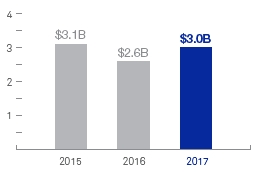

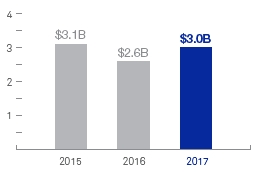

●increase backlog and bookings to support our future business;

●promote pricing discipline on order intake operating margins; and

●efficiently allocate capital to profitable investments to grow our business.

Solid, consistent operational performance driven by the One McDermott Way, consistent focus on liquidity and strong customer relationships drove the execution of McDermott’s strategy and goals in 2017.

| www.mcdermott.com |  |

Table of Contents

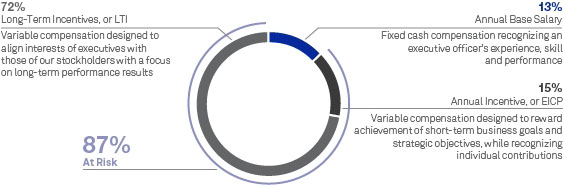

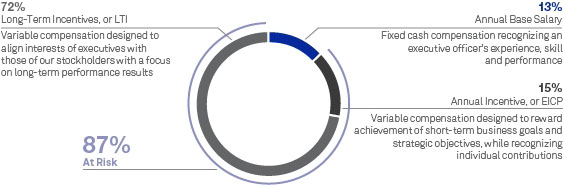

2017 Executive Compensation Highlights

The Compensation Committee is committed to targeting reasonable and competitive total direct compensation for our Named Executive Officers, or NEOs, with a significant portion of that compensation being performance-based. Our Boardcompensation programs are designed to align with and drive achievement of Directors recommends thatour business strategies and provide competitive opportunities. Accordingly, achievement of most of those opportunities depends on the attainment of performance goals and/or stock price performance. McDermott’s compensation programs are designed to provide compensation that:

| | |  | | |  |

| Attracts, motivates and retains high-performing executives | | | Provides performance-based incentives to reward achievement of short and long-term business goals and strategic objectives while recognizing individual contributions | | | Aligns the interests of our executives with those of our stockholders |

The Compensation Committee has designed and administered compensation programs aligned with this philosophy and is committed to continued outreach to stockholders vote “For”to understand and address comments on our compensation programs.

| 2017 COMPENSATION PROGRAM |

Reflecting this philosophy, our NEO compensation arrangements in 2017 provided for the advisory votecontinuing use of three elements of target total direct compensation: annual base salary, annual incentive provided under our Executive Incentive Compensation Plan, or EICP, and long-term incentives, or LTI. In making compensation decisions for 2017, the Compensation Committee considered McDermott’s operating strategy and goals and significantly improved operational and financial performance, with appreciation of the “lower for longer” macro oil and gas environment and comments received during the 2017 stockholder outreach program.

With respect to approve named executive officerplan design, the Compensation Committee maintained consistency:

●in the 2017 EICP performance metrics, with the continued use of operating income, free cash flow, order intake and order intake operating margin; and

●in the 2017 LTI performance metric, with the continued use of relative Return on Average Invested Capital, or relative ROAIC, in consideration of McDermott’s transformation from turnaround and stabilization to optimization for future growth.

| Performance metrics and performance levels used within elements of annual and long-term compensation are designed to support our strategic and financial goals and drive the creation of stockholder value |

| 2018 PROXY STATEMENT |

Table of Contents

2017 Executive Incentive Compensation Plan

| Goal | |  | Performance Metric |

| Drive profitability via improved project execution | | Operating Income |

| Prioritize liquidity needs | | Free Cash Flow |

| Support future business | | Order Intake |

| Promote pricing discipline on new work | | Order Intake Operating Margin |

2017 Long-Term Incentive Plan — Performance Units

| Goal | |  | Performance Metric |

| Efficiently allocate capital to profitable investments | | Relative Return on Average Invested Capital |

| Generate returns for stockholders | | Stock Price Increase |

With respect to levels of compensation, the Compensation Committee generally sought to bring 2017 NEO compensation more in line with market range (generally, within 15% of market median as further described below). For 2017 NEO compensation, the Compensation Committee provided:

●Average annual base salary increases of approximately 6.4% to further align the NEOs’ annual base salaries with market range and, in certain instances, for internal pay equity considerations.

●Increases in annual target bonus awards, resulting in an increase in each NEO’s performance-based compensation.Item 3 — Ratification As a result of AppointmentMcDermott’s 2017 financial performance, each NEO was eligible to earn 1.578x of Deloitte & Touche LLPhis target EICP award, subject to adjustment by the Compensation Committee based on his achievement of individual performance goals.

●Increases to the value of long-term incentives awarded to Messrs. Dickson and Spence as Auditorscompared to 2016, based on their individual performance and to further align the value of their LTI with market range.

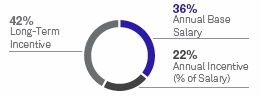

The mix of target total direct compensation for Mr. Dickson for 2017 is shown in the chart below.

| CEO TARGET 2017 COMPENSATION |

Item 3

RATIFICATION OF APPOINTMENT OF ERNST & YOUNG LLP AS AUDITORS |

Our Board of Directors has ratified our Audit Committee’s appointment of DeloitteErnst & ToucheYoung LLP as McDermott’s independent registered public accounting firm for the year ending December 31, 2015,2018, and, as a matter of good governance, we are seeking stockholder ratification of thisthat appointment.

| | | |

| The Board recommends a voteFORthis proposal |  | Page 67 |

| www.mcdermott.com |  |

Table of Contents

TABLE OF CONTENTS

| 2018 PROXY STATEMENT |

Table of Contents

CORPORATE GOVERNANCE

Introduction

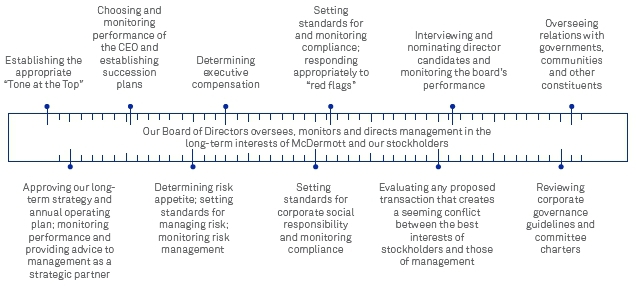

Our Board of Directors recommendsmaintains a strong commitment to corporate governance and has implemented policies and procedures that stockholders vote “For”we believe are among the ratification of Deloitte & Touche LLP as McDermott’s independent registered public accounting firm for the year ending December 31, 2015.best practices in corporate governance.

Communicating with the Board of Directors

Stockholders or other interested persons may send written communications to the independent membersWe maintain a corporate governance section on our Web site which contains copies of our principal governance documents. The corporate governance section may be found atwww.mcdermott.comunder “INVESTORS – Corporate Governance” and “WHO WE ARE – Leadership – Board addressed to Board of Directors (independent members), c/o McDermott International, Inc., Corporate Secretary’s Office, 757 N. Eldridge Pkwy., Houston, Texas 77079.

iv

QUESTIONS AND ANSWERS ABOUT THE

ANNUAL MEETING OF STOCKHOLDERS AND VOTING

What isCommittees.” The corporate governance section contains the purpose of these proxy materials?following documents:

| ● | Amended and Restated Articles of Incorporation (our “Articles of Incorporation”) |

| ● | Amended and Restated By-Laws (our “By-Laws”) |

| ● | Corporate Governance Guidelines |

| ● | Code of Ethics for CEO and Senior Financial Officers |

| ● | Board of Directors Conflicts of Interest Policies and Procedures |

| ● | Audit Committee Charter |

| ● | Compensation Committee Charter |

| ● | Governance Committee Charter |

As more fully described in the Notice, the Board of Directors of McDermott International, Inc. (“McDermott”) has made these materials available to you in connection with our 2015 Annual Meeting of Stockholders, which will take place on May 8, 2015 at 10:00 a.m., local time (the “Annual Meeting” or “Meeting”). We mailed the Notice to our stockholders beginning on March 27, 2015, and our proxy materials were posted on the Web site referenced in the Notice on that same date.

McDermott, on behalf of its Board of Directors, is soliciting your proxy to vote your shares at the 2015 Annual Meeting of Stockholders. We solicit proxies to give all stockholders of record an opportunity to vote on matters that will be presented at the Annual Meeting. In this proxy statement you will find information on these matters, which is provided to assist you in voting your shares.

Who will pay for the cost of this proxy solicitation?

We will bear all expenses incurred in connection with this proxy solicitation, which we expect to conduct primarily by mail. We have engaged The Proxy Advisory Group, LLC to assist in the solicitation for a fee that will not exceed $12,500, plus out-of-pocket expenses. In addition, our officers and regular employees may solicit your proxy by telephone, by facsimile transmission or in person, for which they will not be separately compensated. If your shares are held through a broker or other nominee (i.e., in “street name”) and you have requested printed versionsCode of these materials, we have requested that your broker or nominee forward this proxy statement to you and obtain your voting instructions, for which we will reimburse them for reasonable out-of-pocket expenses. If your shares are held through the McDermott Thrift Plan and you have requested printed versions of these materials, the trustee of that plan has sent you this proxy statement and you can instruct the trustee on how to vote your plan shares.

Who is entitled to vote at, and who may attend, the Annual Meeting?

Our Board of Directors selected March 12, 2015 as the record date (the “Record Date”) for determining stockholders entitled to vote at the Annual Meeting. This means that if you owned McDermott common stock on the Record Date, you may vote your shares on the matters to be considered by our stockholders at the Annual Meeting.

There were 238,476,018 shares of our common stock outstanding on the Record Date. Each outstanding share of common stock entitles its holder to one vote on each matter to be acted on at the meeting.

Attendance at the meeting is limited to stockholders and beneficial owners as of the Record Date or duly appointed proxies. No guests will be admitted, except for guests invited by McDermott. Registration will begin at 9:00 a.m., and the meeting will begin promptly at 10:00 a.m. If your shares are held in “street name” through a broker, bank, trustee or other nominee, you are a beneficial owner, and beneficial owners will need to show proof of beneficial ownership, such as a copy of a brokerage account statement, reflecting stock ownership as of the Record Date in order to be admitted to the meeting. If you are a proxy holder for a stockholder, you will need to bring a validly executed proxy naming you as the proxy holder, together with proof of record ownership of the stockholder naming you as proxy holder. Please note that youBusiness Conduct may be asked to present valid photo identification, such as a valid driver’s license or passport, when you check in for registration. No cameras, recording equipment or other electronic devices will be allowed to be brought into the meeting room by stockholders or beneficial owners.

What is the difference between holding shares as a stockholder of record and as a beneficial owner through a brokerage account or other arrangement with a holder of record?

If your shares are registered in your name with McDermott’s transfer agent and registrar, Computershare Trust Company, N.A., you are the “stockholder of record” of those shares. The Notice and the proxy materials have been provided or made available directly to you by McDermott.

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” but not the holder of record of those shares, and the Notice and the proxy materials have been forwarded to you by your broker, bank or other holder of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record how to vote your shares by using the voting instruction card or by following their instructions for voting by telephone orfound on the Internet.

How do I cast my vote?

Most stockholders can vote by proxy in three ways:

our Web site atwww.mcdermott.comat “WHO WE ARE — Ethics.”

| • | | by Internet atwww.proxyvote.com;

ITEM 1

ELECTION OF DIRECTORS |

If you are a stockholder of record, you can vote your shares in person atUnless otherwise directed, the Annual Meeting or vote now by giving us your proxy via Internet, telephone or mail. You may give us your proxy by following the instructions included in the Notice or, if you received a printed version of these proxy materials, inpersons named as proxies on the enclosed proxy card. If you wantcard intend to vote by mail but have not received a printed version of these proxy materials, you may request a full packet of proxy materials by following the instructions in the Notice. If you vote using either the telephone or the Internet, you will save us mailing expense.

By giving us your proxy, you will be directing us how to vote your shares at the meeting. Even if you plan on attending the meeting, we urge you to vote now by giving us your proxy. This will ensure that your vote is represented at the meeting. If you do attend the meeting, you can change your vote at that time, if you then desire to do so.

If you are the beneficial owner of shares, but not the holder of record,you should refer to the instructions provided by your broker or nominee for further information. The broker or nominee that holds your shares has the authority to vote them, absent your approval, only as to matters for which they have discretionary authority under the applicable New York Stock Exchange (“NYSE”) rules. Neither“FOR” the election of directors nor the advisory vote to approve named executive officer compensation are considered routine matters. That means that brokers may not vote your shares with respect to those matters if you have not given your broker specific instructions as to how to vote. Please be sure to give specific voting instructions to your broker.

If you received a printed version of these proxy materials, you should have received a voting instruction form from your broker or nominee that holds your shares. For shares of which you are the beneficial owner but not the holder of record, follow the instructions contained in the Notice or voting instruction form to vote by Internet, telephone or mail. If you want to vote by mail but have not received a printed version of these proxy materials, you may request a full packet of proxy materials as instructed by the Notice. If you want to vote your shares in person at the Annual Meeting, you must obtain a valid proxy from your broker or nominee. You should contact your broker or nominee or refer to the instructions provided by your broker or nominee for further information. Additionally, the availability of telephone or Internet voting depends on the voting process used by the broker or nominee that holds your shares.

Why did I receive more than one Notice or proxy statement and proxy card or voting instruction form?

You may receive more than one Notice, proxy statement, proxy card or voting instruction form if your shares are held through more than one account (e.g., through different brokers or nominees). Each proxy card or voting instruction form only covers those shares of common stock held in the applicable account. If you hold shares in more than one account, you will have to provide voting instructions as to each of your accounts in order to vote all your shares.

What can I do if I change my mind after I vote?

the nominees. If you are a stockholder of record, you may change your vote by written notice to our Corporate Secretary, by granting a new proxy beforeany nominee should become unavailable for election, the Annual Meeting or by voting in person at the Annual Meeting. Unless you attend the meeting and vote your shares in person, you should change your vote before the meeting using the same method (by Internet, telephone or mail) that you first used to vote your shares. That way, the inspectors of election for the meeting will be able to verify your latest vote.

If you are the beneficial owner, but not the holder of record, of shares, you should follow the instructions in the information provided by your broker or nominee to change your vote before the meeting. If you want to change your vote as to shares of which you are the beneficial owner by voting in person at the Annual Meeting, you must obtain a valid proxy from the broker or nominee that holds those shares for you.

What is a broker non-vote?

If you are a beneficial owner whose shares are held of record by a broker or other holder of record, you must instruct the broker or other holder of record how to vote your shares. If you do not provide voting instructions, your shares will not be voted on any proposal on which the broker does not have discretionary authority to vote. This is called a “broker non-vote.” In these cases, the broker or other holder of record can include your shares as being present at the Annual Meeting for purposes of determining the presence of a quorum but will not be able to vote on those matters for which specific authorization is required under the rules of the NYSE.

For this Annual Meeting, if you are a beneficial owner whose shares are held by a broker or other holder of record, your broker or other holder of record has discretionary voting authority under NYSE rules to vote your shares on the ratification of Deloitte & Touche LLP (“Deloitte”), even if it has not received voting instructions from you. However, such holder does not have discretionary authority to vote on the election of directors or the advisory vote to approve named executive officer compensation without instructions from you, in which case a broker non-vote will result and your shares will not be voted on those matters.

What is the quorum for the Annual Meeting?

The Annual Meeting will be held only if a quorum exists. The presence at the meeting, in person or by proxy, of holders of a majority of our outstanding shares of common stock as of the Record Date will constitute a quorum. If you attend the meeting or vote your shares by Internet, telephone or mail, your shares will be counted toward a quorum, even if you abstain from voting on a particular matter. Broker non-votes willvoted for such substitute nominee as may be treated as present for the purpose of determining a quorum.

Which items will be voted on at the Annual Meeting?

At the Annual Meeting, we are asking you to vote on the following:

the election of John F. Bookout, III, Roger A. Brown, David Dickson, Stephen G. Hanks, Gary P. Luquette, William H. Schumann, III, Mary L. Shafer-Malicki and David A. Trice toproposed by our Board of Directors, each for a term of one year;

the advisory vote to approve named executive officer compensation; and

the ratification of our Audit Committee’s appointment of Deloitte as our independent registered public accounting firm for the year ending December 31, 2015.

WeDirectors. However, we are not aware of any other matterscircumstances that may be presented or acted on at the Annual Meeting. If you vote by signing and returning the enclosed proxy card or using the telephone or Internet voting procedures, the individuals named as proxies on the card may vote your shares, in their discretion, on any other matter requiring a stockholder vote that comes before the meeting.

What are the Board’s voting recommendations?

For the reasons set forth in more detail later in this proxy statement, our Board recommends a vote:

FOR the election of each director nominee;

FOR the advisory vote to approve named executive officer compensation; and

FOR the ratification of our Audit Committee’s appointment of Deloitte as our independent registered public accounting firm for the year ending December 31, 2015.

What are the voting requirements to elect the Directors and to approve each of the proposals discussed in this proxy statement?

Each proposal requires the affirmative vote of a majority of our outstanding shares present in person or represented by proxy at the meeting and entitled to vote and actually voting on the matter. Because votes withheld in the election of any director, abstentions and broker non-votes are not actual votes with respect to a proposal, they will have no effect on the outcome of the vote on any proposal.

Our Corporate Governance Guidelines provide that, in an uncontested election of directors, the Board expects any incumbent director nominee who does not receive “FOR” votes by a majority of shares present in person or by proxy and entitled to vote and either voting “FOR” or registering a decision to withhold a vote with respect to the election of such director to promptly tender his or her resignation to the Governance Committee, subject to acceptance by our Board. Any shares subject to broker non-votes shall not be considered in making any determination pursuant to the immediately preceding sentence. The Governance Committee will then make a recommendation to the Board with respect to the director nominee’s resignation and the Board will consider the recommendation and take appropriate action within 120 days from the date of the certification of the election results.

What happens if I do not specify a choice for a proposal when returning a proxy or do not cast my vote?

You should specify your choice for each proposal on your proxy card or voting instruction form. Shares represented by proxies will be voted in accordance with the instructions given by the stockholders.

If you are a stockholder of record and your proxy card is signed and returned without voting instructions, it will be voted according to the recommendations of our Board. If you do not return your proxy card or cast your vote, no votes will be cast on your behalf onwould prevent any of the items of business at the Annual Meeting.

If you are the beneficial owner, but not the holder of record, of shares and fail to provide voting instructions, your broker or other holder of record is permitted to vote your shares on the ratification of Deloitte as our independent registered public accounting firm. However, absent instructionsnominees from you, your broker or other holder of record may not vote on the election of directors or the advisory vote to approve named executive officer compensation, and no votes will be cast on your behalf for those matters.serving.

| | | |

| Our Board of Directors recommends that stockholders vote “FOR”each of the nominees named below. |

Is my vote confidential?

All voted proxies and ballots will be handled in a manner intended to protect your voting privacy as a stockholder. Your vote will not be disclosed except:

to meet any legal requirements;

in limited circumstances such as a proxy contest in opposition to our Board of Directors;

to permit independent inspectors of election to tabulate and certify your vote; or

to respond to your written comments on your proxy card.

ELECTION OF DIRECTORS

(ITEM 1)

Election Process.Our Articles of Incorporation provide that, at each annual meeting of stockholders, all directors shall be elected annually for a term expiring at the next succeeding annual meeting of stockholders or until their respective successors are duly elected and qualified. Accordingly, on the nomination of our Board, has nominated the following personsJohn F. Bookout, III, David Dickson, Gary P. Luquette, William H. Schumann, III and Mary L. Shafer-Malicki will stand for reelection as directors, and Forbes I.J. Alexander, Philippe Barril, L. Richard Flury, W. Craig Kissel, James H. Miller and Marsha C. Williams will stand for election as directors, at this year’s Annual Meeting, each for a term extending until our 2019 Annual Meeting of one year: John F. Bookout, III, Roger A. Brown, David Dickson, Stephen G. Hanks, Gary P. Luquette, William H. Schumann, III, Mary L. Shafer-Malicki and David A. Trice.Stockholders.

Our By-Laws provide that (1) a person shall not be nominated for election or reelection to our Board of Directors if such person shall have attained the age of 72 prior to the date of election or reelection, and (2) any director who attains the age of 72 during his or her term shall be deemed to have resigned and retired at the first Annual Meeting following his or her attainment of the age of 72. Accordingly, a director nominee may stand for election if he or she has not attained the age of 72 prior to the date of election or reelection.

| www.mcdermott.com |  |

Director Qualifications.Our Governance Committee has determined that a candidate for election to our BoardTable of Directors must meet specific minimum qualifications. Each candidate should:Contents

have a record of integrity and ethics in his/her personal and professional life;

have a record of professional accomplishment in his/her field;

be prepared to represent the best interests of our stockholders;

not have a material personal, financial or professional interest in any competitor of ours; and

be prepared to participate fully in Board activities, including active membership on at least one Board committee and attendance at, and active participation in, meetings of the Board and the committee(s) of which he or she is a member, and not have other personal or professional commitments that would, in the Governance Committee’s sole judgment, interfere with or limit his or her ability to do so.

In addition, the Governance Committee also considers it desirable that candidates contribute positively to the collaborative culture among Board members and possess professional and personal experiences and expertise relevant to our business and industry.

While McDermott does not have a specific policy addressing board diversity, the Board recognizes the benefits of a diversified board and believes that any search for potential director candidates should consider diversity as to gender, ethnic background and personal and professional experiences. The Governance Committee solicits ideas for possible candidates from a number of sources — including independent director candidate search firms, members of the Board and our senior level executives.

Director Nominations.Any stockholder may nominate one or more persons for election as one of our directors at the annual meeting of stockholders if the stockholder complies with the notice, information and consent provisions contained in our By-Laws. See “Stockholders’ Proposals” in this proxy statement and our By-Laws, which may be found on our Web site atwww.mcdermott.comat “About Us — Leadership & Corporate Governance — Corporate Governance.”

The Governance Committee will consider candidates identified through the processes described above and will evaluate the candidates, including incumbents, based on the same criteria. The Governance Committee also takes into account the contributions of incumbent directors as Board

members and the benefits to us arising from their experience on the Board. Although the Governance Committee will consider candidates identified by stockholders, the Governance Committee has sole discretion whether to recommend those candidates to the Board.

2015 Nominees.In nominating individuals to become members of the Board of Directors, the Governance Committee considers the experience, qualifications, attributes and skills of each potential member. Each nominee brings a strong and unique background and set of skills to the Board, giving the Board, as a whole, competence and experience in a wide variety of areas. The Governance Committee and the Board of Directors considered the following information, including the specific experience, qualifications, attributes or skills of each individual, in concluding each individual was an appropriate nominee to serve as a member of our Board for the term commencing at this year’s Annual Meeting (ages are as of May 8, 2015)September 26, 2018).

Unless otherwise directed, the persons named as proxies on the enclosed proxy card intend to vote “FOR” the election of each of the nominees. If any nominee should become unavailable for election, the shares will be voted for such substitute nominee as may be proposed by our Board of Directors. However, we are not aware of any circumstances that would prevent any of the nominees from serving.

Our Board recommends that stockholders vote “FOR” each of the nominees named below.

| FORBES I. J. ALEXANDER | Chief Financial Officer, Jabil, Inc. | |  Age

58 Director Since

2018 Committee Assignments ●Audit Committee |

Professional Highlights ●Jabil, Inc., a product solutions company providing design, manufacturing, supply chain and product management services across various industries ●Chief Financial Officer (September 2004 – Present) ●Treasurer (November 1996 – August 2004) ●Assistant Treasurer (April 1996 – November 1996) ●Controller, Scotland operations (1993 – March 1996) Former Public Company Directorships ●Director, Chicago Bridge & Iron Company N.V. (May 2017 – May 2018) | |

| |

| The Board of Directors is nominating Mr. Alexander in consideration of his extensive executive leadership experience and financial knowledge, having worked as a financial officer within various types of companies over the course of his career. | |

| PHILIPPE BARRIL | Chief Operating Officer, SBM Offshore N.V. | |  Age

53 Director Since

2017 Committee Assignments ●Audit Committee ●Transition Committee (Chair) |

John F. Bookout, III

Professional Highlights ●SMB Offshore N.V., a provider of floating production solutions to the offshore energy industry ●Chief Operating Officer (March 2015 – Present) ●Member of Management Board (April 2015 – Present) ●Technip, S.A., a provider of project management, engineering and construction services for the energy industry ●President and Chief Operating Officer (January 2014 – January 2015) ●Executive Vice President and Chief Operating Officer, Onshore and Offshore (September 2011 – December 2013) ●Senior Vice President, Offshore, Technip France (June 2010 – September 2011) ●Senior Vice President, Offshore & Onshore Product Lines and Technologies, Technip France (November 2009 – May 2010) ●Managing Director, Entrepose Contracting, EPC contractor for the energy industry (2007 – 2009) | | Director Since 2006

|

| |

| The Board of Directors is nominating Mr. Barril in consideration of his executive leadership and international operations experience within the oilfield engineering and construction industry. | |

| 2018 PROXY STATEMENT |

Table of Contents

| JOHN F. BOOKOUT, III | Finance Partner, Apollo Global Management, LLC

| |  Age

64 Director Since

2006 Committee MemberAssignments ●Governance Committee MemberMr. Bookout, 61, has served as

|

Professional Highlights ●Apollo Global Management, LLC, a Managing Director of global investment management firm ●Partner (June 2016 – Present) ●Senior Advisor (October 2015 – June 2016) ●Kohlberg Kravis Roberts & Co., a private equity firm since March 2008. Previously, he served as Senior Advisor to First Reserve Corporation, a private equity firm specializing in the energy industry, from 2006 to March 2008. Until 2006, he was a director ●Managing Director of Energy and Infrastructure (March 2008 – June 2015) ●McKinsey & Company, a global management consulting firm which he joined in 1978. Mr. Bookout previously served as a director(1978 – 2008) ●Managing Partner and Head of North American and European Energy Practices, responsible for McKinsey’s 17 global industry practices ●Held various other senior leadership positions Former Public Company Directorships ●Director, Tesoro Corporation from 2006-2010. (2006 – 2010) | |

| |

The Board of Directors is nominating Mr. Bookout in consideration of his:• globalhis broad executive leadership experience withwithin the oil and gas exploration and development industry and the petroleum refining and marketing industry and oil and gas exploration and development industry;

• expertisehis experience in private equity and finance; and

• experience as a board member of public companies.

|

| finance. | |

Roger A. Brown

| | Director Since 2005

|

|

Compensation Committee Member

Governance Committee Member

From 2005 until his retirement in 2007, Mr. Brown, 70, was Vice President, Strategic Initiatives of Smith International, Inc., a supplier of goods and services to the oil and gas exploration and production industry, the petrochemical industry and other industrial markets. Mr. Brown was President of Smith Technologies (a business unit of Smith International, Inc.) from 1998 until 2005. Mr. Brown has served as a director of Ultra Petroleum Corp. since 2007, and previously served as a director of Boart Longyear Limited from 2010-2014. The Board of Directors is nominating Mr. Brown in consideration of his:

• executive leadership experience in the oil and gas exploration and production industry;

• knowledge of corporate governance issues; and

• experience as a board member of public companies.

|

| DAVID DICKSON | | |

David Dickson

| | Director Since 2013

|

|

President and Chief Executive Officer Mr. Dickson, 47, has served as a member of our Board of Directors and as

| |  Age

50 Director Since

2013 Committee Assignments ●Transition Committee |

Professional Highlights ●McDermott International, Inc. ●President and Chief Executive Officer since December(December 2013 prior to which he served as our – Present) ●Executive Vice President and Chief Operating Officer from October 2013. Mr. Dickson has over 24 years(October 2013 – December 2013) ●Technip, S.A., a provider of offshore oilfieldproject management, engineering and construction business experience, including 11 years of experience with Technip S.A. and its subsidiaries. From September 2008 to October 2013, he served as services for the energy industry ●President of Technip U.S.A. Inc., with oversight responsibilities for all of Technip’s North American operations. In addition to being the President of Technip U.S.A. Inc., Mr. Dickson also had responsibilityoperations and for certain operations in Latin America including Mexico, Venezuela, Colombia and the Caribbean. Mr. Dickson also supported the Technip organization by managing key customer accounts with international oil companies based in the United States. (September 2008 – October 2013) | |

| |

The Board of Directors is nominating Mr. Dickson in consideration of his:•his position as our President and Chief Executive Officer;

•Officer, his extensive executive leadership experience in and significant knowledge of the offshore oilfield engineering and construction business;business, and

• his broad knowledgeunderstanding of the expectations of our core customers.

| |

| www.mcdermott.com |  |

Table of Contents

| L. RICHARD FLURY | Former Chief Executive Officer of Gas, Power & Renewables, BP p.l.c. | |  Age

71 Director Since

2018 Committee Assignments ●Governance Committee (Chair) ●Compensation Committee |

Professional Highlights ●BP p.l.c., an oil and natural gas exploration, production, refining and marketing company ●Chief Executive Officer, Gas, Power & Renewables (1998 – retirement in 2001) ●Executive Vice President, Exploration & Production Sector, Amoco Corp. (acquired by BP p.l.c. in 1998) (1996 – 1998) ●Various other executive roles, Amoco Corp. (1988 – 1996) Current Public Company Directorships ●Director, Callon Petroleum Corporation, an independent oil and natural gas company focused on the acquisition, exploration and development of high-quality assets in the heart of the Permian Basin (2004 – Present)—Audit, Compensation and Strategic Planning & Reserves Committees Former Public Company Directorships ●Director, Chicago Bridge & Iron Company N.V. (2003 – May 2018) ●Director, QEP Resources, Inc. (June 2010 – May 2015) | |

|  | |

|

Stephen G. Hanks

| | Director Since 2009

|

|

Governance Committee Chairman

Audit Committee Member

Mr. Hanks, 64, served in various roles over a 30-year career with Washington Group International, Inc. (and its predecessor, Morrison Knudsen Corporation), an integrated construction and management services company, and from 2000 through 2007 served as President, Chief Executive Officer and a member of its board of directors. Mr. Hanks has also served as a director of Lincoln Electric Holdings, Inc. since 2006 and as a director of The Babcock & Wilcox Company since 2010. The Board of Directors is nominating Mr. HanksFlury in consideration of his:

•his extensive experience in serving in executive leadership, including his position asand director capacities at several public companies, knowledge of the Chief Executive Officerenergy industry, knowledge of Washington Group;

• background and knowledge in the areas of accounting, auditinginternational business and financial reporting, having previously served as a Chief Financial Officer;adeptness.

| |

| W. CRAIG KISSEL | Former President of Commercial Systems, Trane, Inc. • experience

| |  Age

67 Director Since

2018 Committee Assignments ●Compensation Committee (Chair) |